What Does Top-rated Bankruptcy Attorney Tulsa Ok Mean?

What Does Top-rated Bankruptcy Attorney Tulsa Ok Mean?

Blog Article

All about Tulsa Ok Bankruptcy Attorney

Table of ContentsHow Best Bankruptcy Attorney Tulsa can Save You Time, Stress, and Money.Excitement About Best Bankruptcy Attorney TulsaThe 6-Minute Rule for Top Tulsa Bankruptcy LawyersChapter 7 Vs Chapter 13 Bankruptcy for BeginnersWhat Does Best Bankruptcy Attorney Tulsa Do?

The statistics for the other main type, Chapter 13, are also worse for pro se filers. Suffice it to say, speak with an attorney or 2 near you who's experienced with insolvency regulation.Several lawyers additionally provide complimentary examinations or email Q&A s. Take advantage of that. Ask them if personal bankruptcy is certainly the ideal selection for your scenario and whether they believe you'll qualify.

Advertisement Currently that you have actually decided bankruptcy is indeed the right program of activity and you ideally cleared it with a lawyer you'll need to get started on the paperwork. Prior to you dive into all the main personal bankruptcy types, you ought to get your very own papers in order.

The Buzz on Bankruptcy Attorney Near Me Tulsa

Later on down the line, you'll actually require to show that by disclosing all sorts of information regarding your financial affairs. Below's a basic listing of what you'll need when driving ahead: Determining documents like your chauffeur's certificate and Social Safety and security card Income tax return (up to the past four years) Evidence of income (pay stubs, W-2s, self-employed profits, revenue from possessions as well as any type of revenue from federal government advantages) Bank declarations and/or retired life account statements Evidence of value of your assets, such as automobile and genuine estate evaluation.

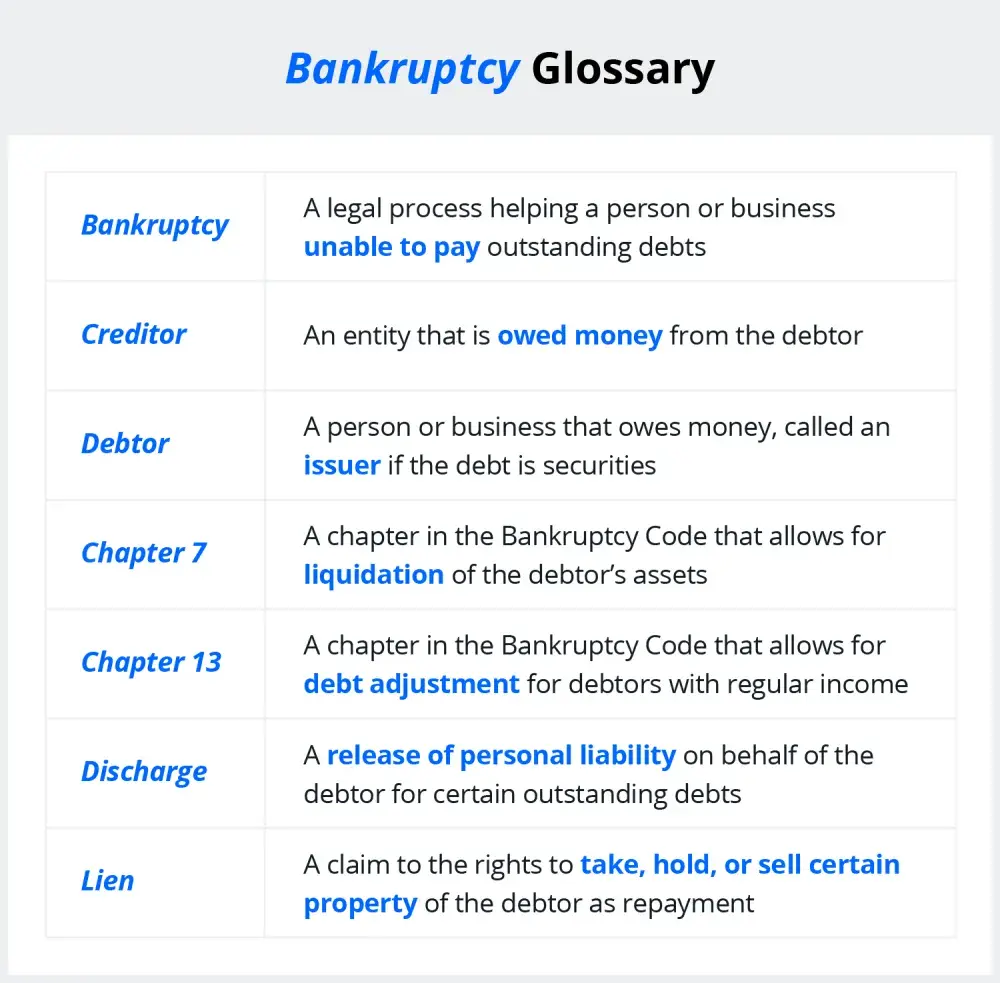

You'll intend to recognize what sort of financial debt you're trying to solve. Debts like child assistance, alimony and specific tax obligation financial debts can not be discharged (and personal bankruptcy can't halt wage garnishment pertaining to those financial debts). Student lending financial obligation, on the various other hand, is not impossible to discharge, yet keep in mind that it is hard to do so (Tulsa OK bankruptcy attorney).

You'll intend to recognize what sort of financial debt you're trying to solve. Debts like child assistance, alimony and specific tax obligation financial debts can not be discharged (and personal bankruptcy can't halt wage garnishment pertaining to those financial debts). Student lending financial obligation, on the various other hand, is not impossible to discharge, yet keep in mind that it is hard to do so (Tulsa OK bankruptcy attorney).If your revenue is as well high, you have one more choice: Chapter 13. This alternative takes longer to settle your financial debts since it needs a long-term payment strategy usually 3 to 5 years prior to some of your remaining debts are cleaned away. The declaring procedure is additionally a great deal much more intricate than Phase 7.

Tulsa Debt Relief Attorney - The Facts

A Chapter 7 bankruptcy remains on your debt record for 10 years, whereas a Phase 13 personal bankruptcy falls off after seven. Both have long lasting effects on your credit rating, and any type of brand-new debt you obtain will likely come with greater rates of interest. Before you send your insolvency types, you have to first finish a required course from a credit therapy company that has been approved by the Department of Justice (with the notable exception of filers in Alabama or North Carolina).

The training course can be completed online, in individual or over the phone. You must finish the course within 180 days of filing for insolvency.

What Does Tulsa Bankruptcy Consultation Mean?

Inspect that you're submitting with the right one based on where you live. If your permanent home has moved within 180 days of filling, you ought to submit in the district where you lived the better part of that 180-day duration.

Typically, your insolvency attorney will certainly work with the trustee, yet you may require to send out the person records such as pay stubs, income tax return, and financial institution account and bank card statements directly. The trustee who was simply appointed to your case will certainly quickly set up a required meeting with you, called the "341 conference" because it's a need of Section 341 of the united state

You will certainly require to supply a prompt checklist of what qualifies as an exemption. Exceptions may put Tulsa OK bankruptcy attorney on non-luxury, main cars; essential home items; and home equity (though these exemptions policies can differ extensively by state). Any residential or commercial property outside the checklist of exceptions is considered nonexempt, and if you don't offer any type of list, after that all your property is considered nonexempt, i.e.

You will certainly require to supply a prompt checklist of what qualifies as an exemption. Exceptions may put Tulsa OK bankruptcy attorney on non-luxury, main cars; essential home items; and home equity (though these exemptions policies can differ extensively by state). Any residential or commercial property outside the checklist of exceptions is considered nonexempt, and if you don't offer any type of list, after that all your property is considered nonexempt, i.e.The trustee wouldn't offer your sports vehicle to quickly pay off the lender. Rather, you would certainly pay your lenders that quantity throughout your payment plan. An usual misunderstanding with personal bankruptcy is that when you submit, you can stop paying your financial obligations. While personal bankruptcy can assist you eliminate many of your unprotected financial debts, such as overdue clinical bills or individual financings, you'll wish to maintain paying your regular monthly settlements for protected financial obligations if you wish to maintain the residential or commercial property.

How Tulsa Ok Bankruptcy Specialist can Save You Time, Stress, and Money.

If you go to risk of repossession and have actually tired all other financial-relief options, then declaring Chapter 13 might postpone the foreclosure and assistance conserve your home. Inevitably, you will still need the revenue to continue making future mortgage payments, along with paying off any kind of late repayments over the training course of your settlement strategy.

The audit might postpone any kind of financial debt alleviation by several weeks. That you made it this much in the procedure is a respectable indicator at the like this very least some of your debts are eligible for discharge.

Report this page